Forward Observer — The Spending of Your Veterans Trust Fund Donations

In 2012 the Veterans Trust Fund was established in Pennsylvania. We thought you might want to know how it is being used this year.

In 2012 the Veterans Trust Fund was established in Pennsylvania. We thought you might want to know how it is being used this year.

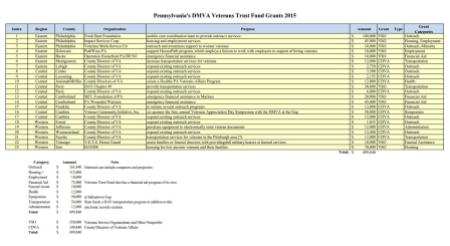

In 2015, fifty-five organizations applied for grants, the sum of which would have amounted to nearly $4.7 million in funding for veterans’ services and programs. Of these, ten grants were subsequently awarded. Since all were competing for $350,000 in grant money, there is an implication: there are needs state government is failing to recognize through the usual means.

To that point, the stated aims for the fund were finding long-term solutions to homelessness, providing behavioral health and peer support programs, providing outreach services supporting reintegration, and “other programs or services that address newly identified, unmet or emerging needs of veterans and their families.”

Additionally, donors’ dollars are being used to finance county Directors of Veterans Affairs efforts and DMVA’s own programs: it awarded $99,840 for 12 Pennsylvania County Directors of Veterans Affairs Offices and a $41,000 grant to Veteran Community Initiative, Inc. to co-sponsor DMVA’s first Veterans Appreciation Day Symposium at its Ft. Indiantown Gap.

Not listed is the $194,000 a year paid to PennDOT to place a veteran status indicator on your driver’s license, effectively hiding a budget line PennDOT should itself prepare as part of the normal appropriations process – if funding is needed at all. Reimbursing PennDOT through donations seems illogical. New Jersey did not encounter this problem over the same issue.

Finally, there has been little mention of this fund is being used to provide emergency financial aid. In itself, that is not wrong, but it should not be done because our state government has dropped the ball. It has not drafted and passed needed legislation to make its existing Veterans’ Emergency Assistance Program more relevant and in the process, has totally de-funded it. Consequently, the Veterans Trust Fund is exclusively performing a legislative assigned mission of another line item appropriation to the tune of about $500,000 or more a year (as of April, $451,783 had been obligated).

We’re not keen on the idea of donations being used to help fund a government agency, state or county, in accomplishing their basic duties specified by law and supposed to be supported with taxes. Things not specified by law are another matter, but must be prudently approved. One does have to wonder how such a beautiful idea, successfully used in other states, resulted in such poorly crafted legislation for execution (Act 194 of 2012).

It is time to appoint a Board of Trustees, as occurs with the other trust funds of the commonwealth, to properly direct the use of funds and recommend the necessary legislative changes.

###

RJH

As of 15 May 2015